Everyone has an opinion on how Blockchain will change business and society. Quite a few startups are working on their Blockchain-based products or services, and some of them are even using initial coin offerings (ICOs) as a funding vehicle. However, it’s hard to find good use cases that haven’t been solved already with more traditional technologies and business models.

To overcome this hurdle I have created a simple framework that might help people to evaluate use cases and identify the most promising ones. There are many things to take into account when evaluating a Blockchain use case but there are few that are crucial, the others can be considered implementation details. We need to begin with the most important one: what class of problems Blockchain is designed to address.

Class of Problems

The Blockchain is an immutable, shared, and distributed ledger. Systems built with a distributed ledger are able to provide a trusted consensus for the origin and ongoing history of a set of shared facts stored in the ledger. This trusted consensus may now be relied upon and operated by multiple parties who have varying levels of trust and mistrust between each other.

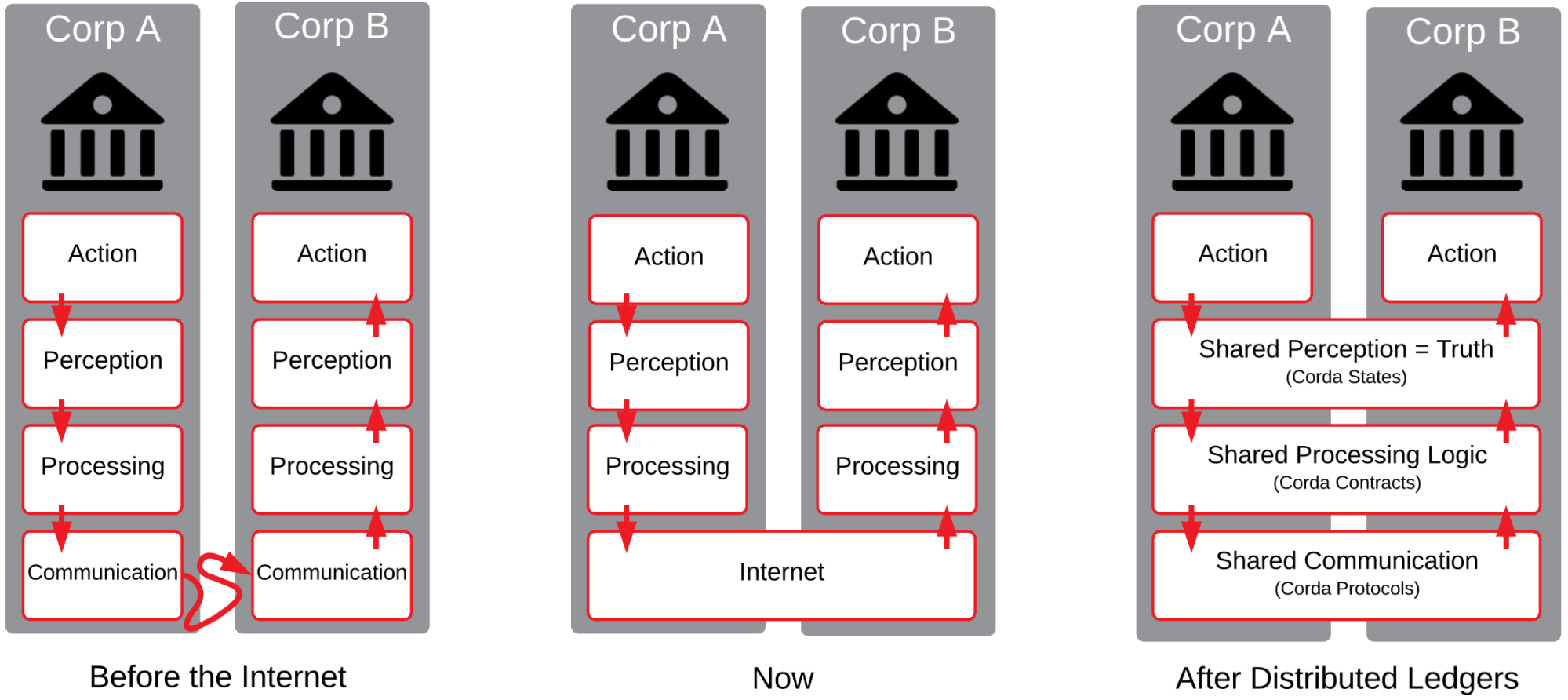

But this use case has already been addressed in the past, without Blockchain. It has been solved using either bilateral agreements and reconciliation or a trusted intermediary (Fig. 1).

Figure 1 – Three ways to solve the same problem, from Corda: an Introduction. (Image Copyright 2018 from the Corda Project licensed under the Apache License, Version 2.0.)

So that’s where you want to start looking for potential uses cases for Blockchain. For there might be reasons for replacing bilateral agreements and trusted intermediaries, and the underlying technologies, with Blockchain. Let’s look at a couple of reasons.

The first reason is those mechanisms might not be available or viable. For example, there are two billion unbanked people in the world. There are several reasons for this, including distance, not enough money to be worth it, burden of documentation requirements and distrust in the financial system. So banks, which are trusted intermediaries and use bilateral agreements and reconciliation to settle transactions between them, are not an accessible or viable solution for some of those people. With Blockchain solutions we could address at least some of those issues and provide banking/financial services to some of the unbanked population that does have access to a mobile phone or other Internet access. To a certain extent, that is what Bitcoin tries to do.

The second reason for replacing with blockchain is when you can improve on the existing technology.

For example, most countries have a real-time gross settlement systems (RTGS). RTGS are “specialist fund transfer systems where the transfer of money or securities takes place from one bank to another on a ‘real time’ and on a ’gross’ basis” (Wikipedia).

In the UK, one of the payment schemes based on an RTGS system is the Clearing House Automated Payment System (CHAPS) that people use when they buy a house.

“CHAPS is one of the largest high-value payment systems in the world, providing efficient and settlement risk-free and irrevocable payments. There are over 25 direct participants and over five thousand financial institutions that make CHAPS payments through one of the direct participants.” (CHAPS)

It processes about 140,000 transactions a day, worth on average £277bn. On October 20, 2014, the system went down for a whole day.

CHAPS uses a trusted intermediary that relies on traditional technologies to provide High Availability and Disaster Recovery. Unfortunately, even state of the art systems of this kind can fail. Blockchain could represent an improvement on the existing technology thanks to its distributed, always-on nature.

- A blueprint for a new RTGS service for the United Kingdom

- Bank of England payment system crashes leaving homebuyers in limbo

- Independent Review of RTGS Outage on 20 October 2014

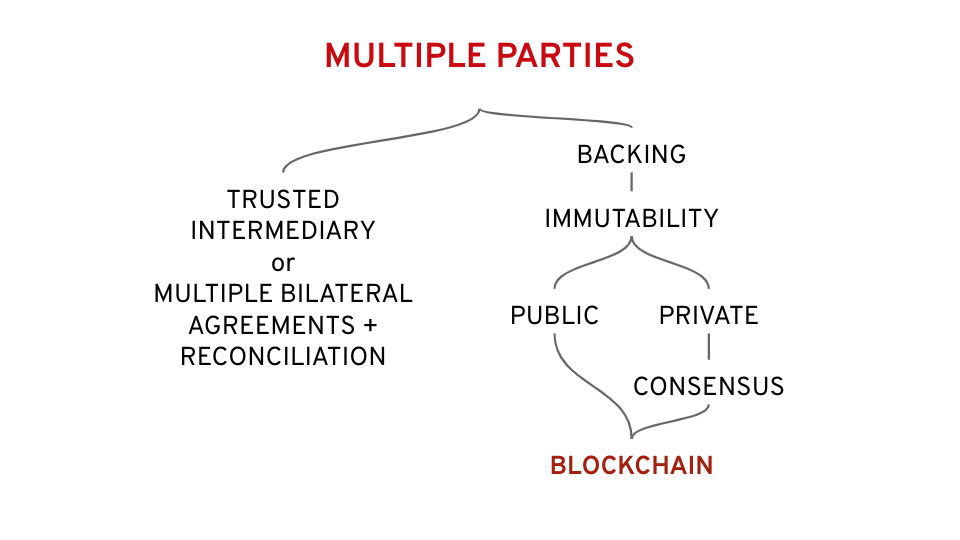

So if we are considering replacing the traditional bilateral agreement or trusted intermediary business models with Blockchain what are the things that we should consider?

Let’s look at the right branch of Figure 2.

Backing

Who stands behind the assets represented on the blockchain? Remember, the blockchain only stores a digital representation of your assets or facts.

You will need to find a way to enforce in the real world what is represented on the ledger, merely having a record won’t do that. You could rely on a legal framework, an insurance or other means, but you need to create that connection between the ledger and the real world.

Digital currencies don’t need this, they are purely digital. When the balance on your bitcoin address goes down to zero, you can’t spend any more bitcoins. The whole technology behind bitcoin, i.e. blockchain, was developed for that purpose: to avoid double spending.

For any other use case, you need to consider these next points carefully.

One example: a speaker at the Blockchain Summit in London made a comment that he would use a distributed ledger to replace the current land registry in a country where there is unrest. He was missing the point. My uncle happens to live in such a country. He has lived there almost his entire life. He is a small business owner and he used to own a small parcel of land. A few years ago the government confiscated it without any reasons and he hasn’t been able to reclaim ownership.

They can’t trust their land registry where he lives not because of the technology, but because it’s very hard to enforce the law there at the moment. So, even if you improve the technology for storing that information, that, in itself, is not going to improve what happens in reality, unless there is a legal framework in place and the means and the willingness to enforce it.

Let’s finish with a counterexample. Prenuptial agreements are legal in the United States. So now that you are getting the gist of it, you may start thinking that you should work on this use case or invest in a company that does. Well, if you do that, don’t bother adding support for Italian, for example, to your app because prenuptial agreements, and post-nuptial agreements for that matter, are explicitly not allowed in Italy. That does not void your use case, but it decreases your addressable market, which is something you want to take into account if you are investing your time or your money on it.

So, to recap: make sure that whatever you build on the blockchain can have tangible outcomes in the real world otherwise what you store on the blockchain ends up being just expensive trivia.

Immutability

Is immutability a desirable property of your use case?

If it is not you need to provide a way to amend what you put on the ledger. Again, this problem has been solved already, by newspapers.

Newspapers are very similar to blockchain for some aspects. Once something is published on paper and distributed it is immutable, and there may be many identical, distributed copies of these facts such as the physical newspapers stored in libraries around the world.

So newspapers had to come up with a way to rectify those facts. They do it by publishing corrections (errata). Unfortunately, fewer people usually read corrections than the original publication. Corrections are usually published sometime after the original mistake, possibly at the end of an unrelated article or in the back of the publication.

We could imagine a similar system to amend facts stored on the Blockchain but it would probably have the same shortcomings: people may struggle to have a complete picture of the facts that includes corrections, and they may end up not trusting either the facts or the corrections.

Alternatively, we could add a mechanism to change the facts but we would need to restrict and secure access to it. Doing this with traditional technologies would void the benefits of implementing a blockchain based solution. This mechanism becomes the weakest link in the chain (pun intended).

So, to recap: blockchain is an excellent technology for storing immutable facts. If you need to rectify those facts in special circumstances, you need to provide a way for doing it and it could weaken your solution to the point of not providing any significant advantages over a traditional alternative.

Consensus Mechanism

The next thing to consider is the consensus mechanism, which is a given if we are creating a solution based on an existing public blockchain. However, if we are launching a new public blockchain or creating a private or consortium blockchain, we need to pick one and it is the most important thing to select.

The consensus mechanism are the rules and procedures that allow us to maintain and update the ledger and to guarantee the trustworthiness of the records. In other words, it is how transactions are added to the blockchain. In the world of bitcoin, it is proof of work and it is known as bitcoin mining. The consensus mechanism determines, among other things:

- the speed of transactions

- energy efficiency

- scalability

- censorship resistance

- tamper resistance

Ontology of Blockchain Technologies. Principles of Identification and Classification

For example proof of work requires solving a cryptographic puzzle to add a block of transactions to the ledger. This is very secure but it is slow and not energy efficient. Just to name a few other examples, Ripple uses Chosen Validators, sometimes referred to as Unique Node List (UNL). This is a form of Proof of Authority (PoA). Ethereum is evaluating to move to Proof of Stake with the Casper protocol.

There isn’t a single consensus mechanism that is a good fit for all use cases. An RTGS system can probably work well with a proof of work. We can likely wait for an hour to settle a transaction worth millions between banks but for microtransactions at point of sales, e.g.

when you buy a cup of coffee, you need a faster mechanism.

Last two things to consider

Finally, when we think we have a good plan for a new blockchain-based solution we need to consider two last important things.

Are we changing the business model?

Blockchain is all about decentralisation. For example, bitcoin is electronic cash that does not require banks to work. If you create a solution that uses a distributed ledger technology such as Blockchain, your solution must be able to work without you. For example, ASX, the Australian Stock Exchange has recently announced that they are going to move to blockchain.

However, if they still require you to deal with them in order to buy and sell shares, you are still relying on a trusted intermediary. So, although there might be a technological advantage for them, this is only a marginal improvement on the existing situation.

To really benefit from blockchain you need to adopt a decentralised business model. Basically, you need to get out of the picture. But if you do that, how are you going to monetise your product/service? Maybe, the only good way of doing it is a token, in other words, an Initial Coin Offering (ICO) or something similar. But this a topic for another article.

What are we really improving?

There are thousands of proposed use cases for Blockchain. Unfortunately, announcements of new use cases are often unclear about what benefits the adoption of Blockchain will bring about. Sometimes the claims are outright wrong but sometimes are surprisingly honest and accurate.

For example, a recent announcement about an initiative to use blockchain to improve the supply chain of goods that need to be stored at a certain temperature, e.g.

pharmaceuticals, states very clearly that the proposed solution can improve the paperwork between parties, but it is not going to guarantee that the good will be stored at the right temperature. That will require other technologies to complement Blockchain (IoT?).

An opposite example are several announcements about tracking specific pieces of produce, say tomatoes. The problem with this use case is that it is impossible to uniquely identify one tomato throughout the supply chain. To identify a single tomato every time that it changes hands throughout the supply chain is unfeasible. It is next to impossible to associate the ripeness and colour that were registered for a tomato at the beginning of the supply with the tomato that I’m holding in my hands at the point of sale.

However, it is more feasible to do that for diamonds. They change hands infrequently and they are worth enough to justify spending time and money to uniquely identify them every time they change hands. That’s why Everledger’s use case is such a good one..

Figure 3 – Use cases: in some case Blockchain is a better fit

Blockchain may be a great improvement on existing solutions, provided that we change the business model and that we make sure that there is an framework in place that creates a connection between the facts stored on the Blockchain and the expected outcomes in the real world. The few things to consider that we discussed in this article are just a start but they are crucial to make sure that we have a potential good use case in our hands.